With Wall Street in full retreat, it makes good sense for tech giants Microsoft and Hewlett Packard -- and even sports wear maker Nike -- to take some of the billions steadily pouring in from sales of Window PCs, HP printers and Nike sneakers, respectively and use some of that cash flow to buy back company shares at bargain outlet prices, says Bill Whyman, head of tech research at International Strategy & Investments.

With Wall Street in full retreat, it makes good sense for tech giants Microsoft and Hewlett Packard -- and even sports wear maker Nike -- to take some of the billions steadily pouring in from sales of Window PCs, HP printers and Nike sneakers, respectively and use some of that cash flow to buy back company shares at bargain outlet prices, says Bill Whyman, head of tech research at International Strategy & Investments.

Whyman points out that Microsoft reported $21.6 billion in cash flow from operations in its fiscal year ended June 30, while HP reported $11.3 billion in cash flow from operations over its most recent three fiscal quarters. "That's a lot of cash," he says. "They can invest it, spend it in sales and marketing, do capital projects, make acquisitions, or give it back to shareholders in the form of dividends and share buybacks."

No one expects Microsoft's latest $40 billion buyback program, to be carried out between now and 2013, to jack up the company's long stagnant share price; but it should help buttress the tech giant's market valuation from getting sucked down the drain, along with the broader stock market, as the financial market melt down unfolds.

"I do think the buyback is a wise move at this time," says tech stocks analyst Sid Parakh of McAdams Wright Ragen. " Microsoft as a company is looking to build shareholder value in the long-term and I believe that they will leverage every downtick in the stock to do so. Bottom line –- it is a cheap stock and shareholders will be well-served" by the buyback plan.

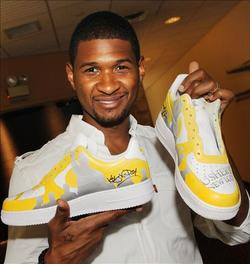

By Byron AcohidoPhoto: R&B star Usher holds a pair of Nikes. (Rick Diamond/Getty Images)

Comments